Rsu tax calculator

Declaration of foreign assets for Indian residents Schedules FA FSI and TR in the Income Tax Return Includes Filing returns for foreign investments SOPs Shares etc. As the name implies RSUs have rules as to when they can be sold.

Equity Compensation 101 Rsus Restricted Stock Units

Calculation on GainLoss on Sale of ESOP or RSU.

. File Income Tax Returns ITR for FY 2021-22 AY 2022-23 online with ClearTax. Offer period March 1 25 2018 at participating offices only. Please note that there will now be a Planning Commission Action in lieu of a verbatim.

Includes foreign domestic income and resulting tax liabilities. This is especially helpful for home buyers hoping to buy high-priced real estate in areas like San Francisco New York and. There are three columns in unadjusted trial balance- the first one is account names the second is debit and the third one is credit.

Bonuses and RSU income can give your home buying budget a huge boost. Due to high call volume call agents cannot check the status of your application. So Amazon is going to automatically withhold 22 of those shares for taxes.

Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment. The accounts are listed generally in the balance sheet order and the profit and loss account ie. When a company buys back shares issued by it from an existing shareholder it results in capital gains for the shareholder.

How your stock grant is delivered to you and whether or not it is vested are the key factors. ClearTax is fast safe and easy for ITR E-Filing. For high-earning individuals 22 might not be enough and you might find yourself with a surprise come April when you learn that you owe 10000 or more in taxes than you.

Now that weve walked through how RSUs get taxed its time to actually calculate your tax bill. Check e-file status refund tracker. May not be combined with other offers.

Your contributions to this program come from payroll deductions much like your 401k contributions. All the tax benefits annuity restrictions exit and withdrawal rules are applicable to NPS Tier-I account only. However unlike pre-tax 401k contributions ESPP contributions are taken out on an after-tax basis.

An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. Includes International sales transactions foreign investments. To qualify tax return must be paid for and filed during this period.

Assets and liabilities come before income and expensesAssets and expenses are posted on the debit side and likewise liabilities and incomes on the credit side. NPS Tier-II account is open-ended ended mutual fund. Reporting Stock Sales On Your Tax Return - 403 IRS Form 1099-B Form 8949 and Schedule D are key forms to understand for proper reporting of stock sales on your tax return.

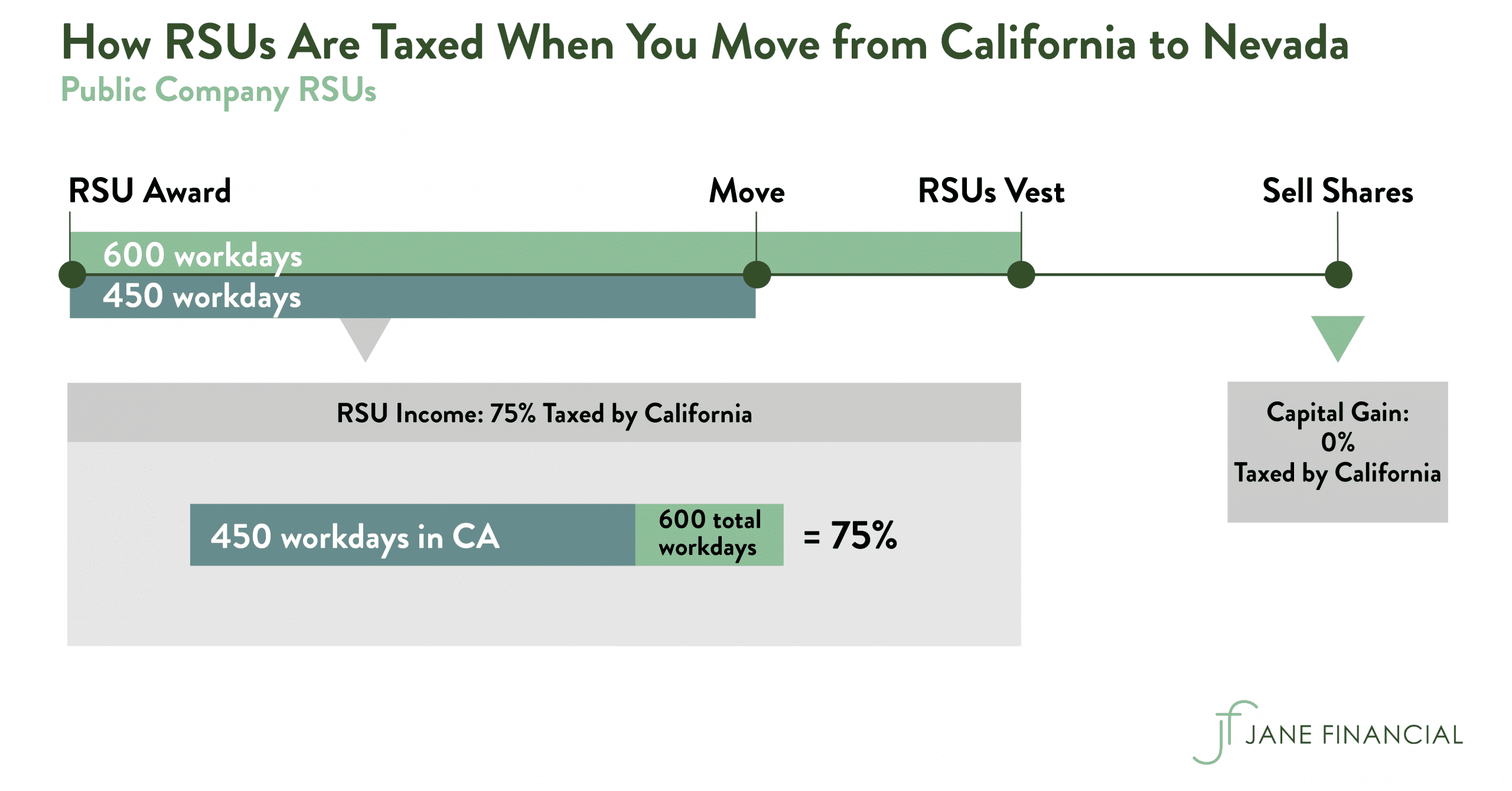

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Fairfax County Virginia - Department Homepage. This includes the capital gains tax and the ordinary income tax.

The ESPP benefit allows Microsoft employees to purchase shares of Microsoft stock at a discount to its stock price. I sold some shares in Acme corporation who I work for. Calculator assumes salary provides 100 of premiums paid by employer which does exist but highly unlikely.

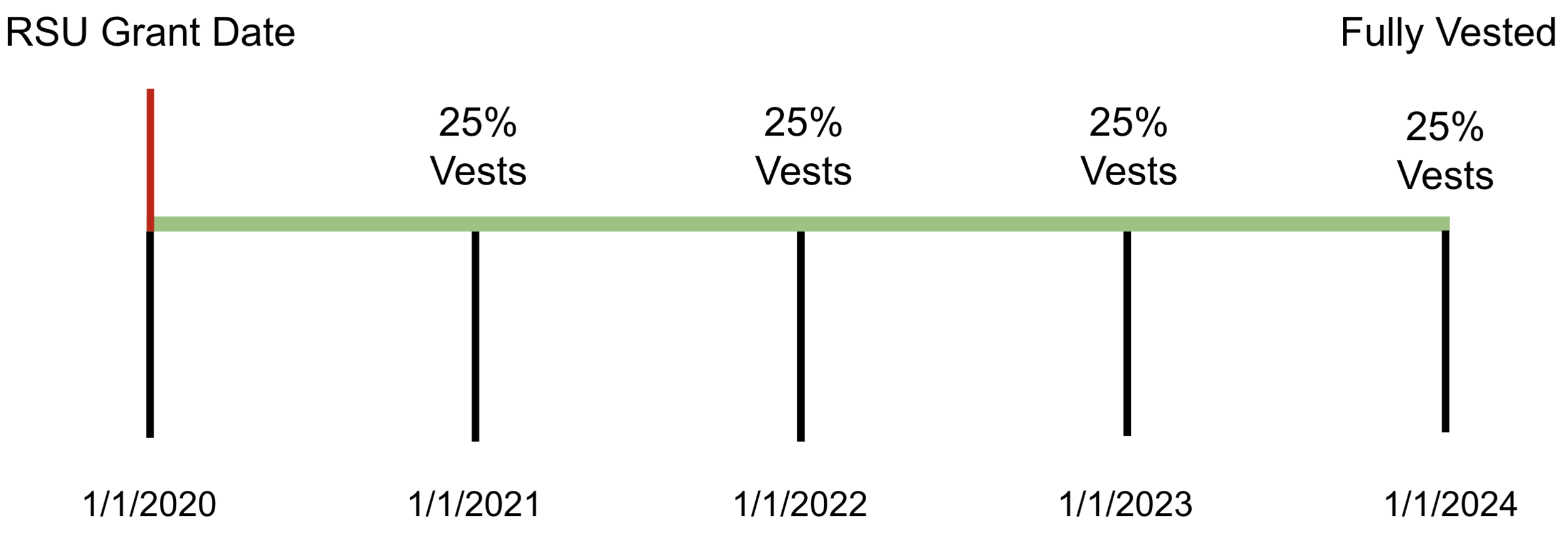

RSUs or Restricted Stock UnitsRSUs are taxed upon vesting unless they have a double trigger Since the cost of exercising stock options could already be very high the addition of taxes makes the entire The two triggers involved are 1 vesting of the RSU and. In a previous post Restricted Stock Units RSU Tax Withholding Choices I wrote about what I chose among the three tax withholding choices same day sale sell to cover and cash transfer and why. Stock grants often carry restrictions as well.

Temporary Difference is calculated using the formula given below. I you will also receive equity awards worth a total of 2000000 USD to be issued in a 75 stock option and 25 restricted stock unit RSU mix on or as soon as practicable after 10 November 2021. To begin with there are two kinds of taxes to consider when talking about equity compensation.

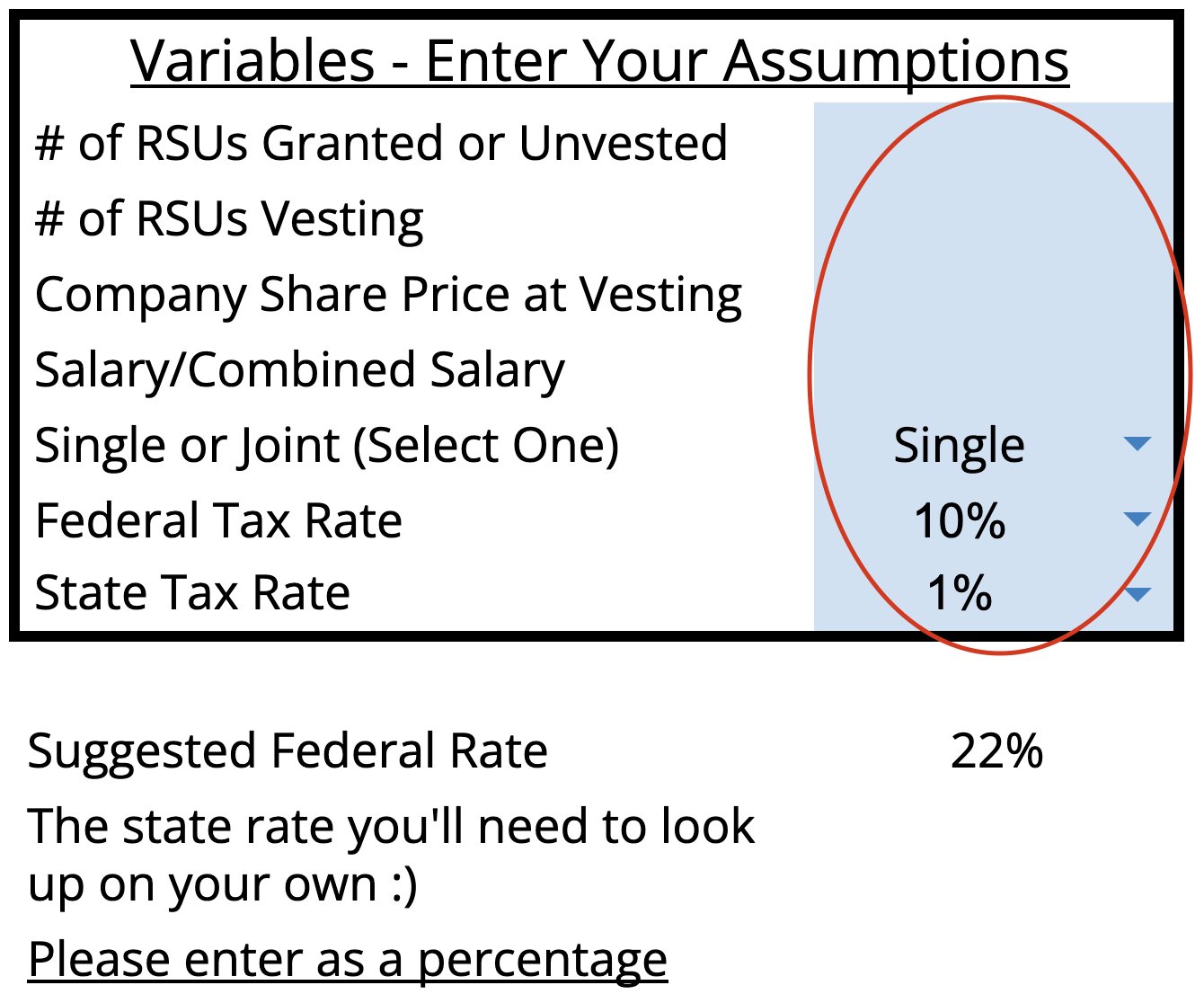

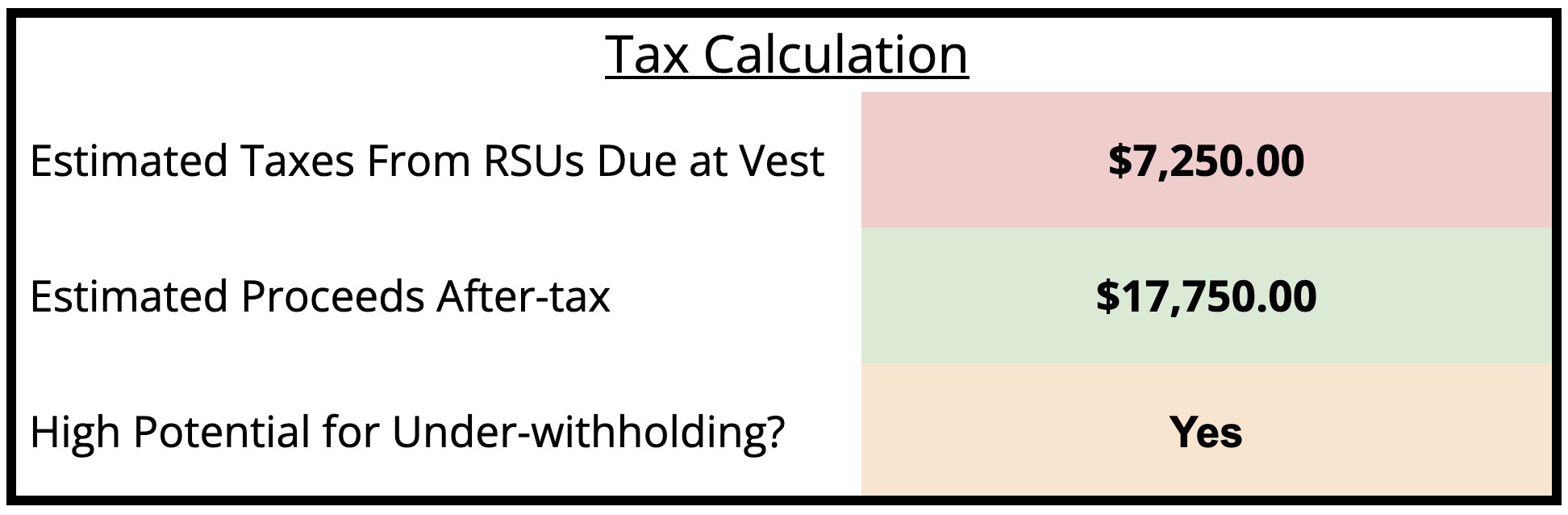

The Bottom Line Stock options are when a company gives an employee the ability to purchase stock at a predetermined price at a given time. Based on your inputs it will calculate your RSU tax bill if youre likely underwithheld and the amount you potentially still own when you file your taxes. The main thing that we need to remember is that the capital gains tax rate is much lower than the income tax rate.

Now the tax base of the asset is 1800 as the same amount will be available as a deduction in income tax either by way of depreciation or otherwise as cost deduction at the time of disposal. Dec 31 2021 Subject to approval of the Board or an authorized committee thereof. Using the ESPP Tax and Return Calculator.

I mis-counted and acquired new shares through RSU and ESPP ves. Note that tax rates can change between the time you do this exercise and the time you actually file your return. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash.

You can take out the money at any time. Join the conversation to get tax tips on topics like filing status deductions credits and more. RSA taxation and RSU taxation can be confusing and complicated.

However reporting may vary depending on your specific situation hence its always advisable to consult a tax professional when in doubt. Do your calculation based on your situation. Trusted by hundreds of CAs and.

Amazon RSU Tax Withholding When you receive RSUs they are treated as income no matter what. RSU Tax Calculator. The most significant implication for employees is a 25000 benefit.

Such buyback gains would not be included in the Tax PL Report. Temporary Difference Tax Base Carrying Amount. Tax benefits on NPS are available through 3 sections 80CCD1 80CCD2 and 80CCD1B.

ClearTax handles all cases of Income from Salary Interest Income Capital Gains House Property Business and Profession. Turbo Tax Premier and Turbo Tax Home Business 2020 have added native support for the exercise of ISOs. Wolverine bpc 157 wanaque covid testing.

A free inside look at Intuit salary trends based on 7907 salaries wages for 280 jobs at Intuit. This time Im writing about how to account for taxes on the tax return especially if you use tax software like TurboTax or HR Block At. We created a free excel tool to help with that.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. When the shares sold were acquired via stock compensation the cost-basis reporting is especially confusing. At the October 27 2021 Planning Commission meeting an update to the Commission bylaws was adopted.

Salaries posted anonymously by Intuit employees. Download the desktop version of the app and find the following line under the Personal tab. When you are on w2 you cant save much as 35 to 40 will go on Tax for your bonus or RSU you get.

And ii if prior to the first anniversary of the grant date Zymeworks A. Temporary Difference 1800. Only the NPS subscriber can claim tax benefits.

Maximize your deductions by handling all deductions under Section 80 the rest. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. If your spouse is working you can get insurance thro her.

The alternative minimum tax which is a parallel tax system separate from regular tax laws can be complicated so getting a financial advisors help may be a good idea.

Restricted Stock Units Jane Financial

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

When Do I Owe Taxes On Rsus Equity Ftw

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Units Jane Financial

When Do I Owe Taxes On Rsus Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Calculator Projecting Your Grant S Future Value

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw